Latest News

- There Is A Chance Of Scattered Rain And Thunderstorms In Kuwait

- In A Week, Kuwait Records 1,542 Accidents And 23,744 Violations

- Kuwait Municipality Sets Record With Zero Abstentions In Financi...

- Primary Schools End Academic Year On May 9

- HH The Amir To Attend World Teachers' Day Honoring Ceremony

- The Civil Service Bureau Prepares To Retire Long-serving Employe...

- Non-Kuwaiti Teachers To Be Hired For New Academic Year By Minist...

- Permits For Houses Over 18 Meters High Are Froze By The Municipa...

- Ministry Of Health Amend 'nature Of Work' Allowance For Nursing...

- Kuwait Institute For Scientific Research Registers 3.0 Richter S...

- Ethiopian Domestic Worker Illicit Baby Dies After Birth

- 8,000 Kuwaitis Apply For French Visas In 2024 1st Quarter

Calculating Indemnity In Kuwait - Frequently Asked Questions

The Labour Law defines the Termination of Services and Employees term it as per their convenience. People call it “Benefits after End of Service”, since I want to make it simple, I am listing it’s Process and related Calculations, for the benefit of the General Public.

The Employees have lot of Doubts on this Termination Indemnity, they often consult under signed for clearing their doubts, Today, I am trying to cover all of their FAQs, so the the people can take benefits by getting knowledge on these terms and condition of the Employers.

1) The Most common Question of any employee working in Kuwait is, whether he is eligible for claiming Termination Indemnity, specially Foreign Nationals

As per Labour Law Any Employee working in Private Sector, Be it Kuwaiti National or Foreign National, is eligible for claiming Termination Indemnity. But some of the Organisation, try to not to pay it to their employees by passing false statements, which is not correct in eyes of law. Another game which some organisation plays with its Employee is that since they are paying some contribution in employees Social Security Funds. Though as per the law, the Social Security fund of any employee is credited by a part from Employee and another by Employer. There is a Fix Percentage from the Parties, the Employee and the Employer. Sometimes, the Organisation decided to pay the sum of Social Security in full with an agreement with the Kuwaiti Nationals that they can deduct the Employees Share of Social Security Fund, from Termination Indemnity. This kind of understanding between the two is not Legal, Organisations can not bargain with the employees in this manner.

Organisations are supposed to Share the fix percentage in the Social Security Fund of any employee and to pay the Termination Indemnity as well.

2) Second, frequently asked question is, if any employee terminates the Contract from his side, whether he is eligible for termination Indemnity?

The Contract Type is the most important factor in this, if you are under fixed contact and leaves the Organisation within 3 years from the date of joining; it is obvious that you have to pay to the company either by adjustment in your Full and final Settlement or adjustment in termination Indemnity. Whereas you have continued your services with the Organisation for consecutively for 3 years, your Employment Contract will be Legal automatically and will be open too. If any employee does not complete his/her 3 years with the organisation, he/she will not be entitled for Termination Indemnity. The contract type doesn’t come under this purview of Services less than 3 years.

For employees, whose services to any organisation, goes beyond 3 years, need to check the 3 rd point for more clarification.

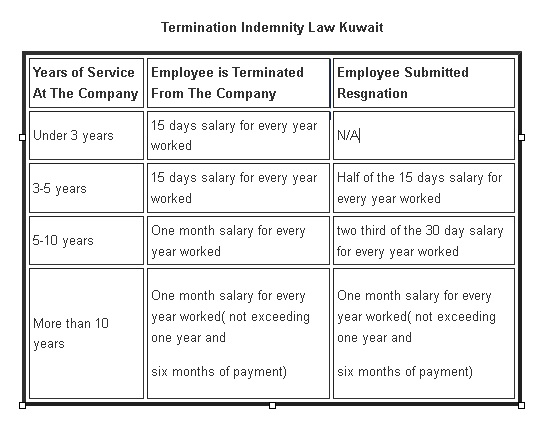

3) How any employee can calculate his/her Termination Indemnity amount?

Calculating the same is not rocket science. Generally, Accounts professionals do it for the people but anyone can learn in some easy steps from the Table (Mentioned below); I prepared this table for the readers for their ready reference. Any Employee, who is paid the remuneration monthly, can get benefit from this table.

Trending News

-

Kuwait Implements Home Biometrics Services Ahead O...

14 April 2024

Kuwait Implements Home Biometrics Services Ahead O...

14 April 2024 -

Kuwait Airways Provides Update On Flight Schedule...

14 April 2024

Kuwait Airways Provides Update On Flight Schedule...

14 April 2024 -

Kuwait Airways Introduces Convenient Home Luggage...

15 April 2024

Kuwait Airways Introduces Convenient Home Luggage...

15 April 2024 -

Expat Residency Law Amended By Kuwait Ministerial...

20 April 2024

Expat Residency Law Amended By Kuwait Ministerial...

20 April 2024 -

Two Expats Are Arrested For Stealing From Salmiya...

17 April 2024

Two Expats Are Arrested For Stealing From Salmiya...

17 April 2024 -

Kuwait Airways Resumes Flights To Beirut And Oman...

15 April 2024

Kuwait Airways Resumes Flights To Beirut And Oman...

15 April 2024 -

Temperature Increases Cause Electricity Load Index...

21 April 2024

Temperature Increases Cause Electricity Load Index...

21 April 2024 -

Thief Returns Stolen Money With An Apology Letter...

15 April 2024

Thief Returns Stolen Money With An Apology Letter...

15 April 2024 -

3 Expats Caught In Salmiya With 213 Bottles Of Loc...

23 April 2024

3 Expats Caught In Salmiya With 213 Bottles Of Loc...

23 April 2024 -

Ministry Of Interior Denies Social Media Rumors Re...

13 April 2024

Ministry Of Interior Denies Social Media Rumors Re...

13 April 2024

Comments Post Comment